But always know just how much set it up requires – and you will what equipment you need – to complete the fresh new renovations you’re planning while making before you could to visit to that solution. Many people undervalue the level of really works, day, and skill required to improve property.

In addition, you might consider using far more basic material to help you upgrade the house unlike upgrading to help you luxury ends. Renovating a property boasts loads of options to possess imaginative disease-resolving, you should be sensible regarding just how innovative you might be happy to get.

Volatile Repair Will cost you

Household reous to have causing completely volatile and you can unforeseen can cost you. Instance, for folks who rip out old cabinets only to pick mildew and mold for the the brand new drywall, you’ll have to eliminate the mold and you can change the drywall prior to your arranged their gorgeous new cabinets. For folks who reduce a good subfloor and watch foundational breaks, you might have to draw in an architectural engineer to fix the damage before you can also consider installing the latest flooring.

When renovating a beneficial fixer-top, you need to do your best to cover every asked costs you might think about. Sadly, possibly the most careful budgeters are unable to assume everything, therefore you truly need to have your allowance getting versatile.

Undesired Traditions Criteria

Home improvements take time. Thus if you plan to make the improvements on your own otherwise get professionals, you will want to expect you’ll live-in a 1 / 2-finished house to have a time ahead of everything is entirely done. Planning your renovations becoming done on the certain specific areas regarding our home at once can reduce new trouble.

Money Problems

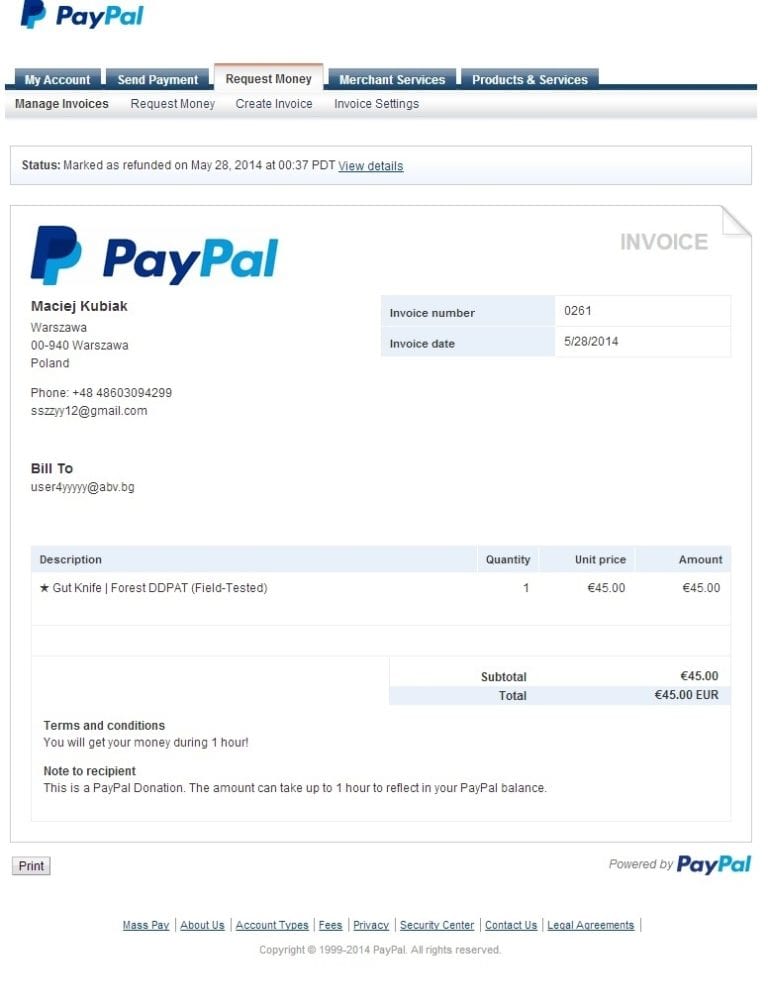

When you yourself have a beneficial preapproval in hand, you may be in the an advantage to having the financing you’d you need on the a move-in in a position home. However, loan providers would be a bit more skeptical throughout the an excellent fixer-upper.

If you cannot buy the newest renovations up front, you might be capable of getting a rehabilitation loan which allows one to roll the expense of your own renovations to your financial. Instead, you may need to make an application for an unsecured loan, that will could have increased rate of interest than simply home financing mortgage.

Full, it isn’t basically recommend to make use of credit cards to invest in an excellent domestic restoration, unless you see certainly that you will be able to spend off the equilibrium.

Now that you be aware of the pros and cons of buying an excellent fixer-upper family, you are in a much better position making the best choice on the regardless if a beneficial fixer-top suits you. But if you’re nonetheless uncertain, use the following inquiries in order to determine whether you ought to get a fixer-upper:

- What is the average rates difference between a great fixer-top and a change-from inside the able domestic within my area?

- Are I prepared to reside in a 1 / 2-completed domestic for around six months or even more?

- In loans in Vilas the morning We ready and ready to put in the works necessary getting good fixer-top basically intend to make the renovations myself?

If you think that a great fixer-upper suits you and your disease, determine what home improvements have to be produced. Estimate the typical cost of those individuals renovations (plus work for many who may not be doing the work on your own) to find out if to get a great fixer-upper will in reality save some costs, please remember to add most on plan for those people unstable will set you back!

Lafayette Federal Is your Home loan Head office

At Lafayette Government Borrowing from the bank Commitment, our company is committed to letting you find the right financial financial support to possess the house you want to buying. If you are considering an excellent fixer-upper, we can help you mention more investment options and this can be around.

Laisser un commentaire